Ford confirmed Friday it plans to invest $2.5 billion to build new engines and transmissions in Mexico and will eventually hire an additional 3,800 workers in a move that underscores a movement of automotive investment south from Canada and and the U.S.

Ford said it will invest:

- $1.1 billion to build a new engine plant within its plant in Chihuahua, Mexico to build new gasoline engines. Those engines will be exported to the U.S., Canada, South America and the Asia-Pacific region for use in Ford's small car. That plant will employ . . .

CONTINUE READING THIS NEWS ARTICLE BY BECOMING A PVDN SUBSCRIBER!

SUBSCRIBE NOW! >> SUBSCRIBE TO OUR NEWS ON WHATSAPP CHANNELS HERE (FROM YOUR CELL PHONE!)<<

Popular posts:

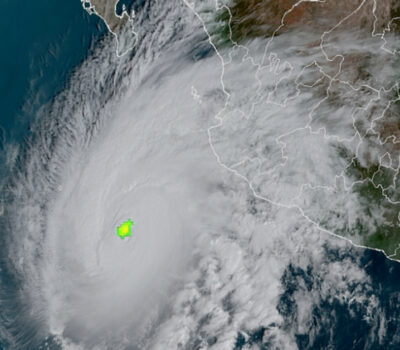

Mexican Navy Secretariat Releases 2024 Hurricane Season Forecasts Puerto Vallarta, Mexico - As the 2024 hurricane season approaches, anticipation and concern linger about the potential impact of these powerful natural phenomena. In response to these inquiries, the Secretary of the Navy (Semar) of Mexico has unveiled its forecasts, shedding light on what the upcoming season may entail. Season Commencement: The initiation of the…

Mexican Navy Secretariat Releases 2024 Hurricane Season Forecasts Puerto Vallarta, Mexico - As the 2024 hurricane season approaches, anticipation and concern linger about the potential impact of these powerful natural phenomena. In response to these inquiries, the Secretary of the Navy (Semar) of Mexico has unveiled its forecasts, shedding light on what the upcoming season may entail. Season Commencement: The initiation of the… Get to Know Puerto Vallarta’s Most Traditional Beach Snack Puerto Vallarta, Mexico - Strolling along Puerto Vallarta's sandy stretches, one can't help but be enticed by the offerings of beachside vendors. From the comforting aroma of banana bread to the zesty allure of mangoes with chamoy, the options are as diverse as they are delectable. But amidst this cornucopia of treats, there's one delicacy…

Get to Know Puerto Vallarta’s Most Traditional Beach Snack Puerto Vallarta, Mexico - Strolling along Puerto Vallarta's sandy stretches, one can't help but be enticed by the offerings of beachside vendors. From the comforting aroma of banana bread to the zesty allure of mangoes with chamoy, the options are as diverse as they are delectable. But amidst this cornucopia of treats, there's one delicacy… Viva Aerobús Expands Air Routes, Including New Connection to Puerto Vallarta Puerto Vallarta, Mexico - To bolster connectivity and cater to the burgeoning demand for air travel, Viva Aerobús, a prominent Mexican low-cost airline, has announced the introduction of seven new national routes originating from the Felipe Ángeles International Airport (AIFA). Among these freshly unveiled destinations stands Puerto Vallarta, a popular resort city on Mexico's Pacific…

Viva Aerobús Expands Air Routes, Including New Connection to Puerto Vallarta Puerto Vallarta, Mexico - To bolster connectivity and cater to the burgeoning demand for air travel, Viva Aerobús, a prominent Mexican low-cost airline, has announced the introduction of seven new national routes originating from the Felipe Ángeles International Airport (AIFA). Among these freshly unveiled destinations stands Puerto Vallarta, a popular resort city on Mexico's Pacific… Price of Gasoline in Puerto Vallarta is the Most Expensive in Mexico Puerto Vallarta, Mexico - During the weekly update of the Federal Consumer Prosecutor's Office (Profeco) on Monday, April 15, David Aguilar, the head of the agency, highlighted concerning trends in fuel prices in Jalisco. Aguilar pointed out that in the state, particularly in Puerto Vallarta, citizens are grappling with exorbitant rates for both premium and…

Price of Gasoline in Puerto Vallarta is the Most Expensive in Mexico Puerto Vallarta, Mexico - During the weekly update of the Federal Consumer Prosecutor's Office (Profeco) on Monday, April 15, David Aguilar, the head of the agency, highlighted concerning trends in fuel prices in Jalisco. Aguilar pointed out that in the state, particularly in Puerto Vallarta, citizens are grappling with exorbitant rates for both premium and… Nearshoring in Mexico Does Not Meet Economic Expectations Puerto Vallarta, Mexico - The World Bank has adjusted its growth forecast for Mexico, downgrading it to 2.3% from the 2.6% previously estimated in January. This revision comes as a result of the absence of anticipated investment influxes linked to the relocation of foreign companies' plants and the hype over nearshoring. William Maloney, the chief…

Nearshoring in Mexico Does Not Meet Economic Expectations Puerto Vallarta, Mexico - The World Bank has adjusted its growth forecast for Mexico, downgrading it to 2.3% from the 2.6% previously estimated in January. This revision comes as a result of the absence of anticipated investment influxes linked to the relocation of foreign companies' plants and the hype over nearshoring. William Maloney, the chief… Record Whale Rescues Mark 2023-2024 Season in Banderas Bay During the 2023-2024 whale watching season, the Regional Network for Whale Entanglement Response (RABEN) teams successfully freed 11 entangled whales, as reported by Astrid Frisch Jordán, the national coordinator of the Whale Assistance Network groups. These teams tirelessly worked to ensure the safety of these magnificent creatures, yet their mission remains ongoing even as the…

Record Whale Rescues Mark 2023-2024 Season in Banderas Bay During the 2023-2024 whale watching season, the Regional Network for Whale Entanglement Response (RABEN) teams successfully freed 11 entangled whales, as reported by Astrid Frisch Jordán, the national coordinator of the Whale Assistance Network groups. These teams tirelessly worked to ensure the safety of these magnificent creatures, yet their mission remains ongoing even as the… 5-Year-Old Allegedly Murdered in Puerto Vallarta by Father Found Dead in Plastic Trash Bag Puerto Vallarta, Mexico - The tranquil streets of the Moderna neighborhood of Puerto Vallarta were shattered by a grim discovery this Wednesday, April 10. A 5-year-old boy, allegedly murdered by his father, was found lifeless, discarded in a black bag amongst the refuse. Authorities swiftly responded to the distressing report, dispatched to Gloria Marin and…

5-Year-Old Allegedly Murdered in Puerto Vallarta by Father Found Dead in Plastic Trash Bag Puerto Vallarta, Mexico - The tranquil streets of the Moderna neighborhood of Puerto Vallarta were shattered by a grim discovery this Wednesday, April 10. A 5-year-old boy, allegedly murdered by his father, was found lifeless, discarded in a black bag amongst the refuse. Authorities swiftly responded to the distressing report, dispatched to Gloria Marin and… Cultural Clash: Complaints of Noise by Expats Spark Debate Across Mexico Puerto Vallarta, Mexico - In Mexico, the vibrant tapestry of culture is woven with the threads of music, celebration, and tradition. However, recent complaints from expatriates, primarily of American origin, have sparked a debate on the intersection of cultural identity and noise pollution. Mazatlán's Sinaloan Band Protest In late March, the boardwalks of Mazatlán, Sinaloa,…

Cultural Clash: Complaints of Noise by Expats Spark Debate Across Mexico Puerto Vallarta, Mexico - In Mexico, the vibrant tapestry of culture is woven with the threads of music, celebration, and tradition. However, recent complaints from expatriates, primarily of American origin, have sparked a debate on the intersection of cultural identity and noise pollution. Mazatlán's Sinaloan Band Protest In late March, the boardwalks of Mazatlán, Sinaloa,… Pride Pet Parade Returns to Puerto Vallarta for Second Consecutive Year Puerto Vallarta, Mexico - On May 20, 2024, Puerto Vallarta will once again embrace its furry companions and their human counterparts as the PV Pride Pet Parade returns for its second edition. This vibrant event, dedicated to celebrating the bond between pets and their guardians, will grace the Malecón of Puerto Vallarta at sunset, promising…

Pride Pet Parade Returns to Puerto Vallarta for Second Consecutive Year Puerto Vallarta, Mexico - On May 20, 2024, Puerto Vallarta will once again embrace its furry companions and their human counterparts as the PV Pride Pet Parade returns for its second edition. This vibrant event, dedicated to celebrating the bond between pets and their guardians, will grace the Malecón of Puerto Vallarta at sunset, promising… Mexico’s President Welcomes American “Invasion” Amid Gentrification Criticism Puerto Vallarta, Mexico - During today's session of La Mañanera, the president´s daily news conference each morning, President Andrés Manuel López Obrador (AMLO) acknowledged the significant influx of American citizens into Mexico, characterizing it as a "fraternal invasion." Despite criticism surrounding gentrification, AMLO emphasized that Americans are welcome in Mexico, attributing their migration to the…

Mexico’s President Welcomes American “Invasion” Amid Gentrification Criticism Puerto Vallarta, Mexico - During today's session of La Mañanera, the president´s daily news conference each morning, President Andrés Manuel López Obrador (AMLO) acknowledged the significant influx of American citizens into Mexico, characterizing it as a "fraternal invasion." Despite criticism surrounding gentrification, AMLO emphasized that Americans are welcome in Mexico, attributing their migration to the…