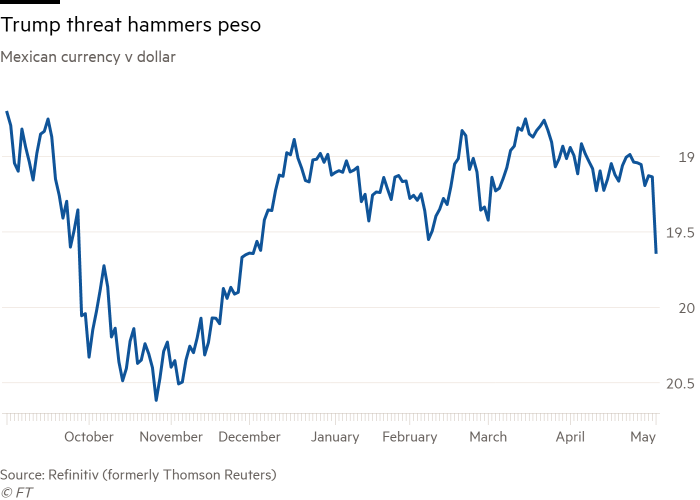

The Mexican peso slumped to a five-month low and the cost of insuring exposure to Mexico’s sovereign debt rose to its highest in two months after U.S. President Donald Trump threatened to impose 5% tariffs on all imports from its southern neighbor.

The Mexican peso sank as much as 3% after Trump said the tariff would start on June 10 and rise to 25% by Oct. 1, unless illegal immigration across the southern border is stopped.

“It’s clearly negative for Mexico, but with this being escalated at a time when the China situation is still not resolved it shows that Trump views tariffs as a weapon he can use without damage to the U.S. economy,” said Jon Harrison, managing director, emerging markets macro strategy at TS Lombard. “That’s worrying and sends a bad signal for the outlook for global trade overall.”

Trump is engaged in a trade war with China after accusing Beijing of reneging on promises to make structural changes to its economic practices.

Mexican five-year credit default swaps rose 2 basis points from Thursday’s close to 125 bps, their highest since the end of March, data from IHS Markit showed.

The Europe-listed Xtrackers MSCI Mexico UCITS exchange-traded fund slumped 6% on Friday. The U.S.-listed iShares MSCI Mexico exchange-traded fund was down 5.7% in premarket trading.

Reporting By Tom Arnold, editing by Karin Strohecker

The Mexican peso slumped to a five-month low and the cost of insuring exposure to Mexico’s sovereign debt rose to its highest in . . .