Mexico is quickly becoming a hotspot for international investors and financial institutions worldwide following a slew of historic reforms in late 2013 that opened up Mexico’s national oil company (PEMEX) to foreign investment in its considerable oil and gas reserves for the first time in 76 years.

“According to the latest estimates from the U.S. Energy Information Administration (EIA), Mexico has technically recoverable shale resources of 545 trillion cubic feet (cf) of natural gas and 13.1 million barrels of crude oil and condensate,” states Dr. Kent Moors, an internationally recognized expert in oil and natural gas policy . . .

CONTINUE READING THIS NEWS ARTICLE BY BECOMING A PVDN SUBSCRIBER!

>> SUBSCRIBE TO OUR NEWS ON WHATSAPP CHANNELS HERE (FROM YOUR CELL PHONE!)<<

Popular posts:

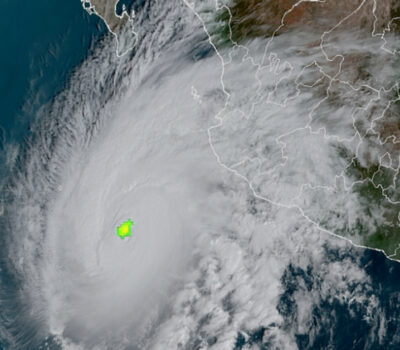

Mexican Navy Secretariat Releases 2024 Hurricane Season Forecasts Puerto Vallarta, Mexico - As the 2024 hurricane season approaches, anticipation and concern linger about the potential impact of these powerful natural phenomena. In response to these inquiries, the Secretary of the Navy (Semar) of Mexico has unveiled its forecasts, shedding light on what the upcoming season may entail. Season Commencement: The initiation of the…

Mexican Navy Secretariat Releases 2024 Hurricane Season Forecasts Puerto Vallarta, Mexico - As the 2024 hurricane season approaches, anticipation and concern linger about the potential impact of these powerful natural phenomena. In response to these inquiries, the Secretary of the Navy (Semar) of Mexico has unveiled its forecasts, shedding light on what the upcoming season may entail. Season Commencement: The initiation of the… Get to Know Puerto Vallarta’s Most Traditional Beach Snack Puerto Vallarta, Mexico - Strolling along Puerto Vallarta's sandy stretches, one can't help but be enticed by the offerings of beachside vendors. From the comforting aroma of banana bread to the zesty allure of mangoes with chamoy, the options are as diverse as they are delectable. But amidst this cornucopia of treats, there's one delicacy…

Get to Know Puerto Vallarta’s Most Traditional Beach Snack Puerto Vallarta, Mexico - Strolling along Puerto Vallarta's sandy stretches, one can't help but be enticed by the offerings of beachside vendors. From the comforting aroma of banana bread to the zesty allure of mangoes with chamoy, the options are as diverse as they are delectable. But amidst this cornucopia of treats, there's one delicacy… Viva Aerobús Expands Air Routes, Including New Connection to Puerto Vallarta Puerto Vallarta, Mexico - To bolster connectivity and cater to the burgeoning demand for air travel, Viva Aerobús, a prominent Mexican low-cost airline, has announced the introduction of seven new national routes originating from the Felipe Ángeles International Airport (AIFA). Among these freshly unveiled destinations stands Puerto Vallarta, a popular resort city on Mexico's Pacific…

Viva Aerobús Expands Air Routes, Including New Connection to Puerto Vallarta Puerto Vallarta, Mexico - To bolster connectivity and cater to the burgeoning demand for air travel, Viva Aerobús, a prominent Mexican low-cost airline, has announced the introduction of seven new national routes originating from the Felipe Ángeles International Airport (AIFA). Among these freshly unveiled destinations stands Puerto Vallarta, a popular resort city on Mexico's Pacific… Price of Gasoline in Puerto Vallarta is the Most Expensive in Mexico Puerto Vallarta, Mexico - During the weekly update of the Federal Consumer Prosecutor's Office (Profeco) on Monday, April 15, David Aguilar, the head of the agency, highlighted concerning trends in fuel prices in Jalisco. Aguilar pointed out that in the state, particularly in Puerto Vallarta, citizens are grappling with exorbitant rates for both premium and…

Price of Gasoline in Puerto Vallarta is the Most Expensive in Mexico Puerto Vallarta, Mexico - During the weekly update of the Federal Consumer Prosecutor's Office (Profeco) on Monday, April 15, David Aguilar, the head of the agency, highlighted concerning trends in fuel prices in Jalisco. Aguilar pointed out that in the state, particularly in Puerto Vallarta, citizens are grappling with exorbitant rates for both premium and… Puerto Vallarta Gears Up for the 2024 Marathon Puerto Vallarta is abuzz with anticipation as it braces to host the fifth edition of its renowned Marathon, slated to kick off on April 21. This eagerly awaited sporting spectacle has firmly entrenched itself as a highlight on the global athletic calendar, drawing participants from diverse corners of the world. The 2024 Puerto Vallarta Marathon…

Puerto Vallarta Gears Up for the 2024 Marathon Puerto Vallarta is abuzz with anticipation as it braces to host the fifth edition of its renowned Marathon, slated to kick off on April 21. This eagerly awaited sporting spectacle has firmly entrenched itself as a highlight on the global athletic calendar, drawing participants from diverse corners of the world. The 2024 Puerto Vallarta Marathon… Cultural Clash: Complaints of Noise by Expats Spark Debate Across Mexico Puerto Vallarta, Mexico - In Mexico, the vibrant tapestry of culture is woven with the threads of music, celebration, and tradition. However, recent complaints from expatriates, primarily of American origin, have sparked a debate on the intersection of cultural identity and noise pollution. Mazatlán's Sinaloan Band Protest In late March, the boardwalks of Mazatlán, Sinaloa,…

Cultural Clash: Complaints of Noise by Expats Spark Debate Across Mexico Puerto Vallarta, Mexico - In Mexico, the vibrant tapestry of culture is woven with the threads of music, celebration, and tradition. However, recent complaints from expatriates, primarily of American origin, have sparked a debate on the intersection of cultural identity and noise pollution. Mazatlán's Sinaloan Band Protest In late March, the boardwalks of Mazatlán, Sinaloa,… Mexico’s President Welcomes American “Invasion” Amid Gentrification Criticism Puerto Vallarta, Mexico - During today's session of La Mañanera, the president´s daily news conference each morning, President Andrés Manuel López Obrador (AMLO) acknowledged the significant influx of American citizens into Mexico, characterizing it as a "fraternal invasion." Despite criticism surrounding gentrification, AMLO emphasized that Americans are welcome in Mexico, attributing their migration to the…

Mexico’s President Welcomes American “Invasion” Amid Gentrification Criticism Puerto Vallarta, Mexico - During today's session of La Mañanera, the president´s daily news conference each morning, President Andrés Manuel López Obrador (AMLO) acknowledged the significant influx of American citizens into Mexico, characterizing it as a "fraternal invasion." Despite criticism surrounding gentrification, AMLO emphasized that Americans are welcome in Mexico, attributing their migration to the… Pride Pet Parade Returns to Puerto Vallarta for Second Consecutive Year Puerto Vallarta, Mexico - On May 20, 2024, Puerto Vallarta will once again embrace its furry companions and their human counterparts as the PV Pride Pet Parade returns for its second edition. This vibrant event, dedicated to celebrating the bond between pets and their guardians, will grace the Malecón of Puerto Vallarta at sunset, promising…

Pride Pet Parade Returns to Puerto Vallarta for Second Consecutive Year Puerto Vallarta, Mexico - On May 20, 2024, Puerto Vallarta will once again embrace its furry companions and their human counterparts as the PV Pride Pet Parade returns for its second edition. This vibrant event, dedicated to celebrating the bond between pets and their guardians, will grace the Malecón of Puerto Vallarta at sunset, promising… Citizens of Puerto Vallarta Still Feel Safe Putting The City in Seventh Place in the Country Puerto Vallarta, Jalisco, continues to shine as one of Mexico's safest cities, securing its position among the nation's top 10 cities where citizens feel most secure, according to the latest National Urban Public Safety Survey (ENSU) conducted by INEGI. The survey, which evaluates citizen perceptions of safety, covers the first quarter of the year and…

Citizens of Puerto Vallarta Still Feel Safe Putting The City in Seventh Place in the Country Puerto Vallarta, Jalisco, continues to shine as one of Mexico's safest cities, securing its position among the nation's top 10 cities where citizens feel most secure, according to the latest National Urban Public Safety Survey (ENSU) conducted by INEGI. The survey, which evaluates citizen perceptions of safety, covers the first quarter of the year and… Upcoming Shows at Act2 Puerto Vallarta Promise an Array of Spectacular Entertainment Act2 Puerto Vallarta, a hub for top-notch entertainment in the heart of Zona Romantica, is gearing up for a series of exciting shows that promise to dazzle audiences with their diversity and talent. From benefit concerts to groundbreaking ballet performances and unforgettable tribute shows, there's something for everyone to enjoy. PV STRONG: A Benefit for…

Upcoming Shows at Act2 Puerto Vallarta Promise an Array of Spectacular Entertainment Act2 Puerto Vallarta, a hub for top-notch entertainment in the heart of Zona Romantica, is gearing up for a series of exciting shows that promise to dazzle audiences with their diversity and talent. From benefit concerts to groundbreaking ballet performances and unforgettable tribute shows, there's something for everyone to enjoy. PV STRONG: A Benefit for…