The U.S. Geological Survey says a relatively strong earthquake has been recorded in the Pacific Ocean west of Mexico.

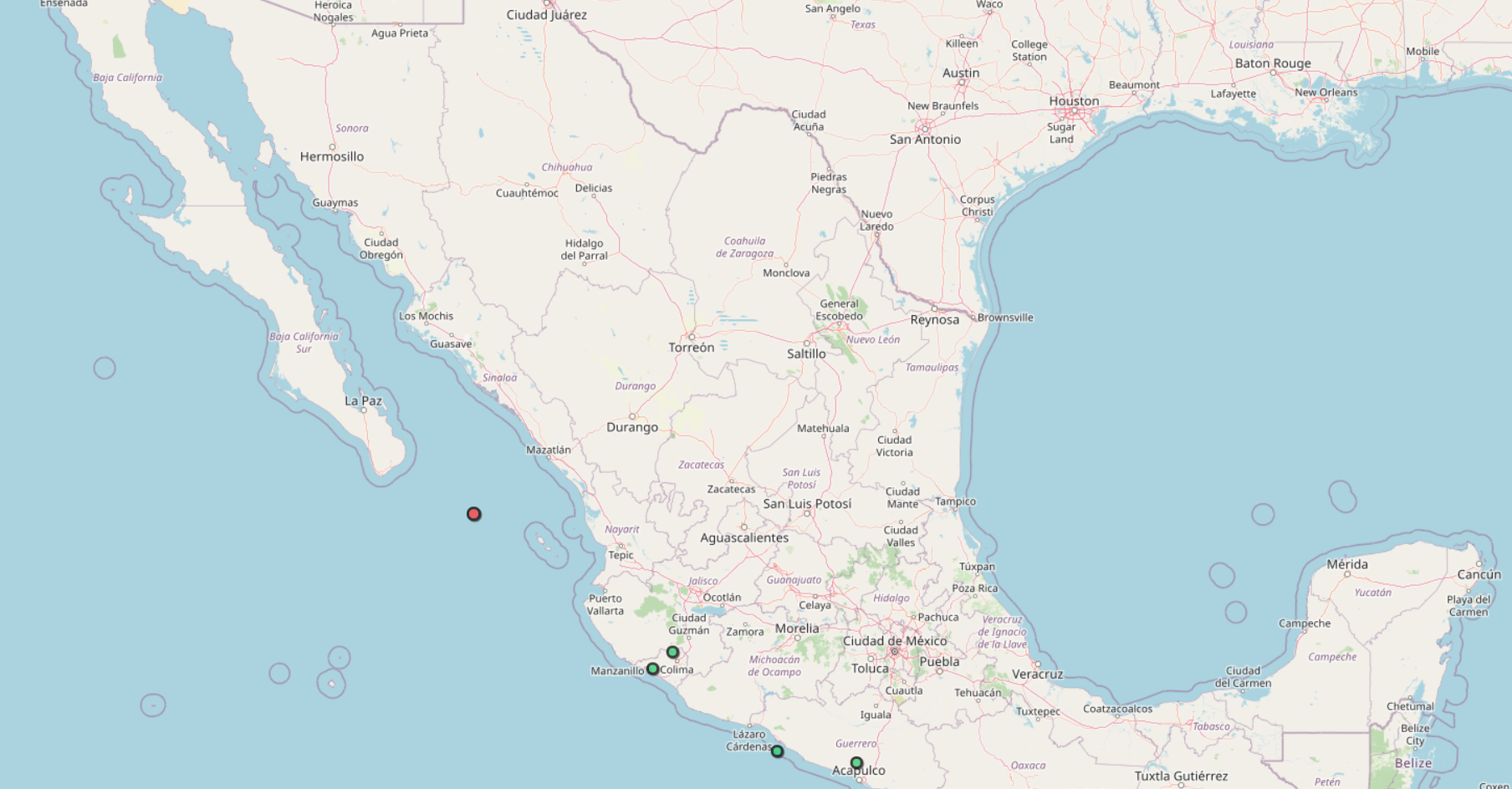

The quake, with a preliminary magnitude of 6.1, hit at 3:46 a.m. local time Friday at a shallow depth of 10 kilometers (6 miles). The epicenter was 173 km (108 miles) east southeast of the resort city of San Jose del Cabo, on the southern tip of the Baja California peninsula.

No tsunami warning was issued.

Read Full Story